Generation Plant Brokerage

A turnkey, income-producing 2.1 MW AC solar asset with a fixed $0.30/kWh contract through July 2037. Located at 310 Commerce Park, Sharon VT, in an industrial park along I-89. Ideal for 1031 exchange or cash buyers seeking reliable yield.

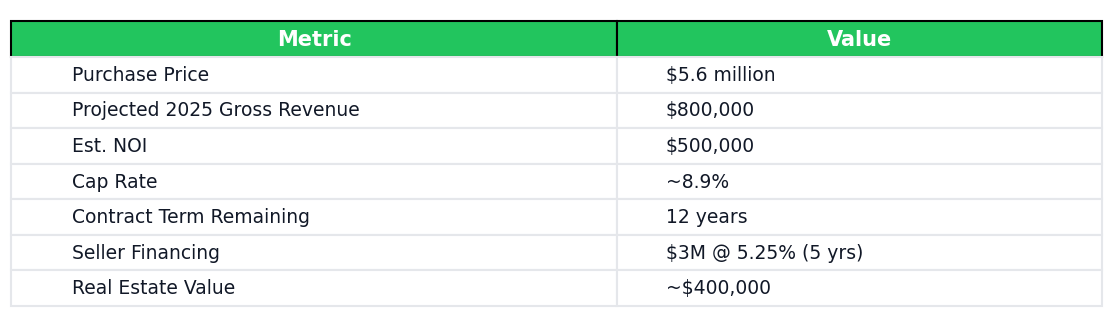

Asking: $5.6M

Seller Financing: $3.0M @ 5.25% / 5 yrs (optional)

Contract remaining: 12 years

Real estate value: ~$400k

Turnkey O&M available

Executive Summary

- Capacity: 2,100 kW AC (2.54 MW DC); 20×95kW + 2×100kW Solectria inverters.

- Modules: 9,562×230W (2011) + 1,152×295W (2013); TerraFix fixed-tilt @ 25°, true south.

- Monitoring: Tigo panel-level optimizers; 3-phase interconnect to GMP.

- Spare inventory: 11 new Solectria 95kW units; on-site O&M equipment.

- Spare parts + machinery estimated value: $400,000.

- Fee-simple 19.6 acres; storage building easement; industrial park with year-round access.

CPG Docket #7700 (2011; amended 2013). Standard Offer via VEPPI. Transfer supported at closing.

Performance & Financial

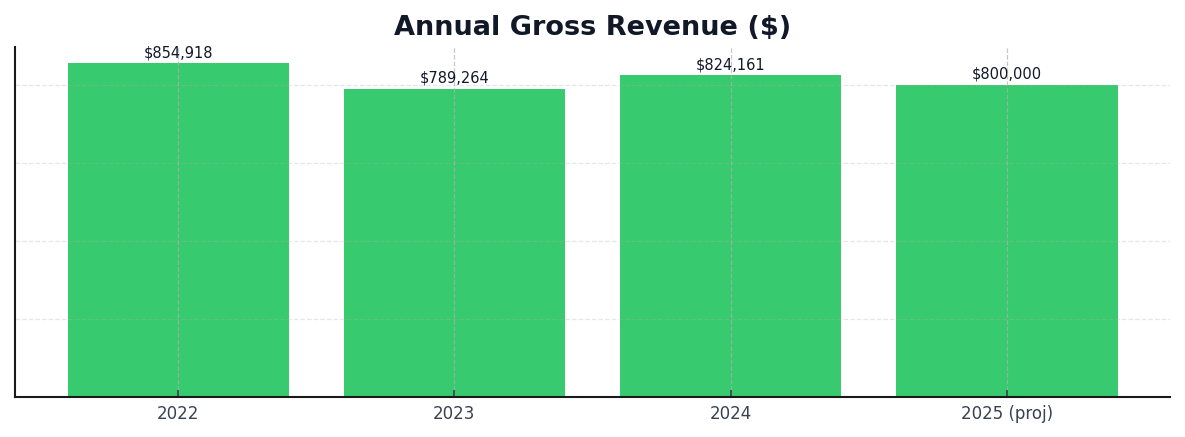

| Year | Production (kWh) | Gross Revenue ($) |

|---|---|---|

| 2022 | 2,849,726 | 854,918 |

| 2023 | 2,630,879 | 789,264 |

| 2024 | 2,747,203 | 824,161 |

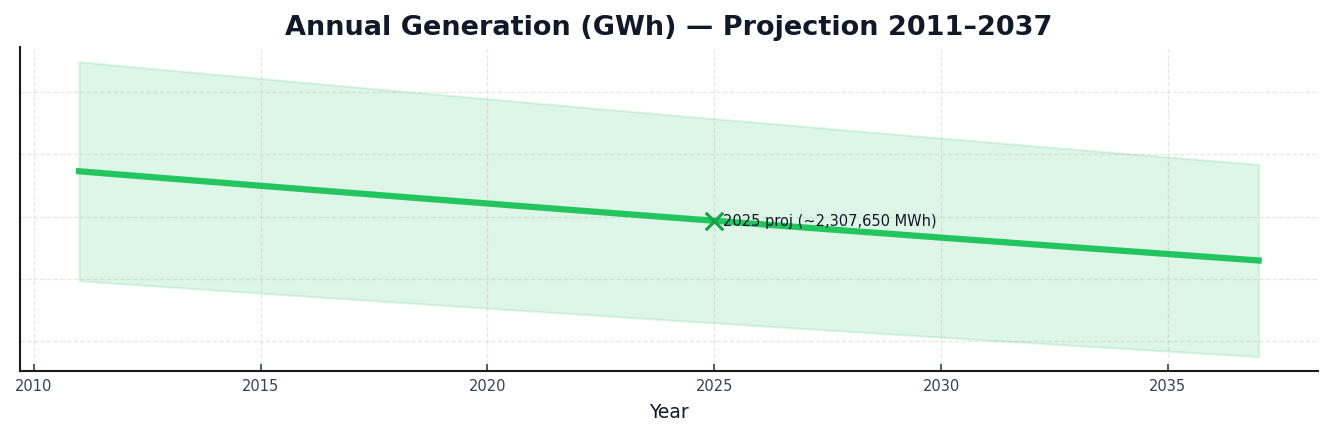

| 2025 (proj) | 2,307,650 | ~800,000 |

Conservative forward guidance reflects a ~16% production reduction vs. 2024. Estimated operating margin ~60–65%; indicative NOI ~$500,000; cap-rate ~8.9% at ask.

Why It’s Compelling

- Irreplicable PPA SPEED Standard Offer is closed; fixed $0.30/kWh is far above new-build PPAs (<$0.12/kWh).

- Cashflow certainty State-facilitated contract via VEPPI through 2037.

- Asset security Fee-simple land, no lease payments; includes spare inverters and machinery.

- Turnkey O&M Continuity available for a modest annual fee (maintenance, monitoring, compliance).

1031 Exchange Fit

Deeded real estate plus permanent improvements make this asset appropriate for Section 1031 exchange buyers seeking to roll gains from commercial/income properties into a stable, income-producing renewable plant with tangible residual value and 12 years of fixed revenue remaining.

Transaction

- Price: $5,600,000 (cash preferred; optional seller note up to $3.0M @ 5.25% / 5yrs)

- Structure: 100% membership interest sale; deed transfer of land; CPG transfer supported.

- Process: NDA → full proforma & data room → site visit/virtual tour → LOI/offer.

Contact

Tim Post — Broker, GreenEdge Energy Solutions, LLC

South Burlington, Vermont 05403

✉︎ te.post@gmail.com | ☎ 802-328-8881 | greenedge.eco

All figures are believed accurate but not guaranteed; buyer to verify. Projections are illustrative and subject to irradiance, operational, and market variables.